Private Equity Advancing Healthcare & Life Sciences Innovation

By maintaining their positions at the helm, these leaders can fully realize their visions, strengthened by the collaboration with Ampersand’s experienced team. Our commitment to these partnerships helps ensure that each company benefits from our deep industry knowledge and resources, driving innovation and success.

Our founder-focused approach is a defining tenet, working with the visionaries we support to execute their missions with precision and confidence while benefiting from our team’s strategic support and life sciences knowledge.

Hear from Our Portfolio CompaniesFounder & CEO Stories

Our founder-focused approach is not only an investment strategy, but a deep commitment to fostering an environment where founders remain at the helm of their organizations while benefiting from the guidance and collaboration offered by the experienced Ampersand team.

Explore Founder & CEO StoriesEnabling Growth on a Global Scale

With more than 30 years dedicated to the life sciences sector and a global presence supported by offices in North America and Europe, Ampersand Capital Partners has built a strong reputation and notable history as an industry leader at the forefront of transformative investments serving science. However, we are more than investors; we are passionate about science and collaborative business partners forging the next generation of healthcare leaders.

Deep Experience Across Core Life Sciences Segments

Laboratory Products

Laboratory Services

Contract Manufacturing

Pharma Services

Specialty Products

Our Focus & Expertise

Investment Criteria

Company Size

Investment Size

Ownership

Geography

Europe

APAC

The investment criteria presented herein serves as a general guideline and is provided for illustrative purposes only. Ampersand may deviate from these guidelines in its discretion. Accordingly, the actual investments may differ materially from the guideline set out herein. There is no assurance that investment made pursuant to these guidelines will result in a positive investment performance.

Industry Insights

- Lab Products

- Articles

A Fast, Simplified Approach to Quantitative Headspace Analysis of Volatile Impurities in Drug and Packaging Products

- Lab Services

- Webinars

Cryo-EM for Epitope Mapping

- Pharma Services

- Blogs

Advantages of Cas9 mRNA for Gene Editing:

Precision, Control & Cost Effective

- Pharma Services

- Articles

The evolving mRNA landscape

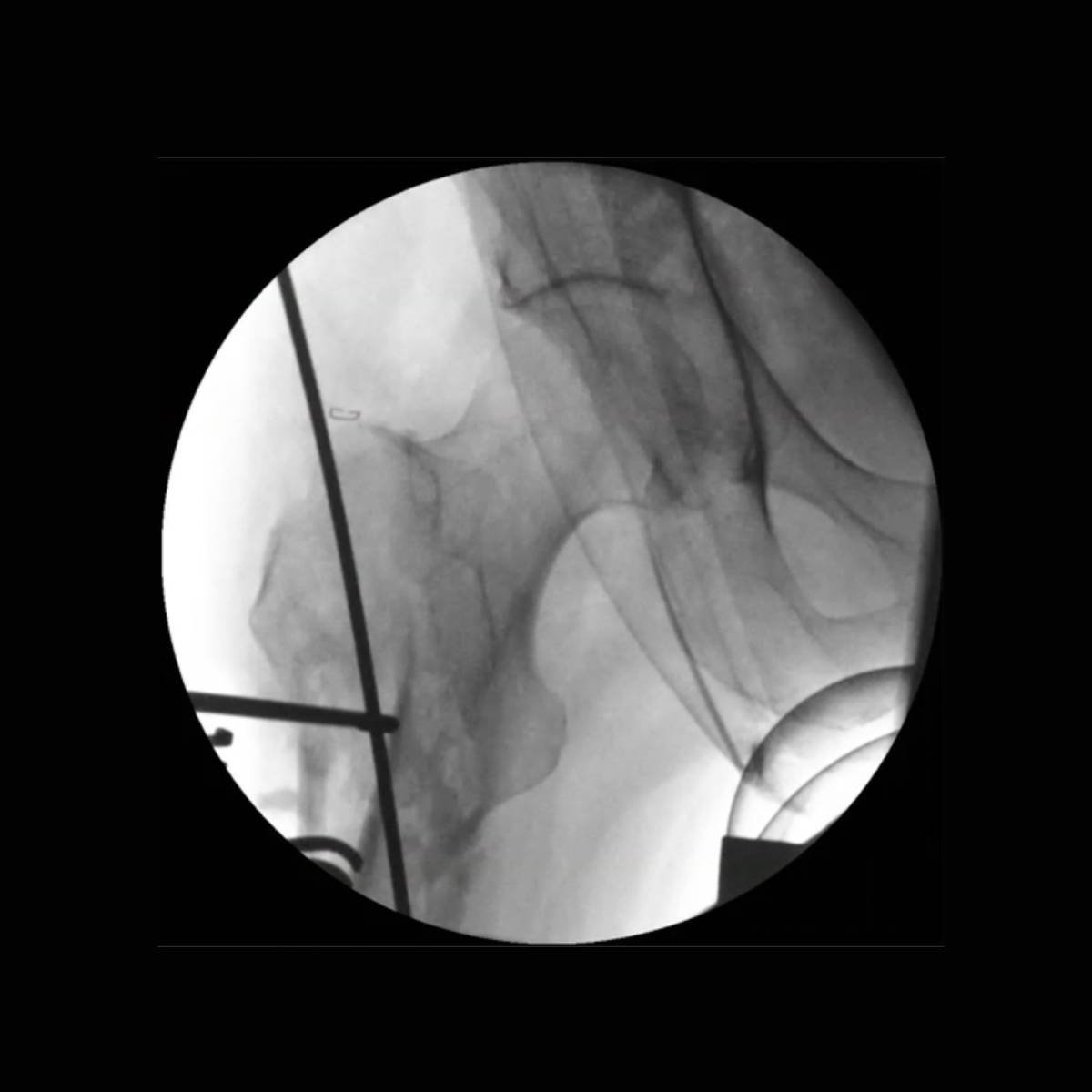

- Specialty Products

- Videos

Treatment of Long Bone Nonunion:

The Role of the Diamond Concept

Ampersand Capital Partners LLC (“Ampersand”) is a registered investment adviser. Ampersand’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Accordingly, the publication of Ampersand’s web site on the Internet should not be construed by any consumer and/or prospective client as Ampersand’s solicitation to effect, or attempt to effect transactions in securities, or the rendering of personalized investment advice for compensation, over the Internet. Any subsequent, direct communication by Ampersand with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. A copy of Ampersand’s current written disclosure statement discussing Ampersand’s business operations, services, and fees is available at the SEC’s investment adviser public information website – www.adviserinfo.sec.gov or from Ampersand upon written request. Ampersand does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Ampersand’s web site or incorporated herein, and takes no responsibility therefor. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. This website and information are provided for guidance and information purposes only. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy. This website and information are not intended to provide investment, tax, or legal advice.