Adaptas

Ray Roy and Peter Graves founded Detector Technology in 1983 with its original facility located in Brookfield, MA. The company specialized in supplying electron multipliers, essential components for mass spectrometers and evolved into Adaptas Solutions, a global contract manufacturer of mass spectrometry components serving large OEMs.

When Jay Ray and his wife Laura took over Detector Technology in the 1990’s, it was a moment of great pride to be entrusted to lead the family business. The company experienced strong growth and success over the decades to follow, expanding its manufacturing capabilities to include other technologies for mass spectrometry while maintaining a strong focus on their area of expertise.

However, Jay and Laura, engineers with deep sector knowledge, recognized gaps in their skill set necessary to scale a large business. This realization led them to seek a partner who could complement their technical expertise with a strong business strategy.

Their search led them to Ampersand Capital Partners, attracted by the firm’s 30 years of experience and unique specialization in life sciences. Jay and Laura were particularly drawn to Ampersand’s collaborative, founder-friendly approach to investing. It was vital for the Rays to remain centrally involved in the business while partnering with a team capable of expanding their operations while making a lasting impact on the pharmaceutical industry.

Ampersand’s approach would allow the Rays to retain operational control of the company they had built while benefiting from the resources and expertise of a leading private equity firm. By 2020, the partnership had enabled the business to flourish into Adaptas Solutions, a global leading provider of mission-critical components for complex laboratory instruments in the life sciences, diagnostics and lab automation markets.

“The foundation of what Ampersand was looking to do – keeping the founders intact yet building a portfolio that allowed our family to take our vision forward – was absolutely a match made in heaven for us.” –Jay Ray

Keys to Success

Prior to joining Ampersand’s portfolio, Detector Technology had begun diversifying its offerings, a strategy that caught the attention of the Ampersand team. Recognizing the potential in this approach, Ampersand invested in the company and partnered closely with Jay, Laura, and their leadership team to accelerate and expand this diversification strategy. The partnership began with the acquisition of Scientific Instrument Services (SIS) in early 2018, followed by the addition of ETP Ion Detect in late 2018. These acquisitions aligned well with Detector Technology’s capabilities, creating a natural synergy that made the business fundamentally critical to mass spectrometry manufacturing.

This addition of SIS brought mass spectrometry filaments and ion optics development software into the company’s growing technology portfolio, marking Detector Technology’s first significant step beyond its original niche. Soon after, the integration of Australian company ETP Ion Detect further expanded the enterprise’s capabilities. ETP’s expertise in discrete dynode ion detectors and ion grids not only enhanced the company’s product offering but also represented its geographic expansion into international markets, paving the way for future global growth.

“They really wanted to understand my vision; my thoughts on where I could take this business, what the market was going to look like, and how collectively we could put that together to engineer a successful outcome.” –Jay Ray

With a commitment to delivering value beyond capital investment, Ampersand recognized the necessity for an enhanced business strategy to complement Detector Technology’s technical expertise. One of the first major steps was forming a new Board of Directors. Ampersand leveraged its extensive network and industry knowledge to identify and recruit key individuals who could provide the strategic guidance and business expertise that Detector Technology needed to scale effectively.

The new Board members brought a wealth of experience in corporate strategy, finance, and industry-specific knowledge. Their collective expertise complemented the Detector Technology team’s scientific and technical background, creating a well-rounded leadership bench capable of steering the company through its next phase of growth.

“Everywhere I had a gap, Ampersand had a solution. They started to make introductions to key people from their network that ended up becoming our Board of Directors. You could see the thought process behind putting a team together that met our specific needs.” –Jay Ray

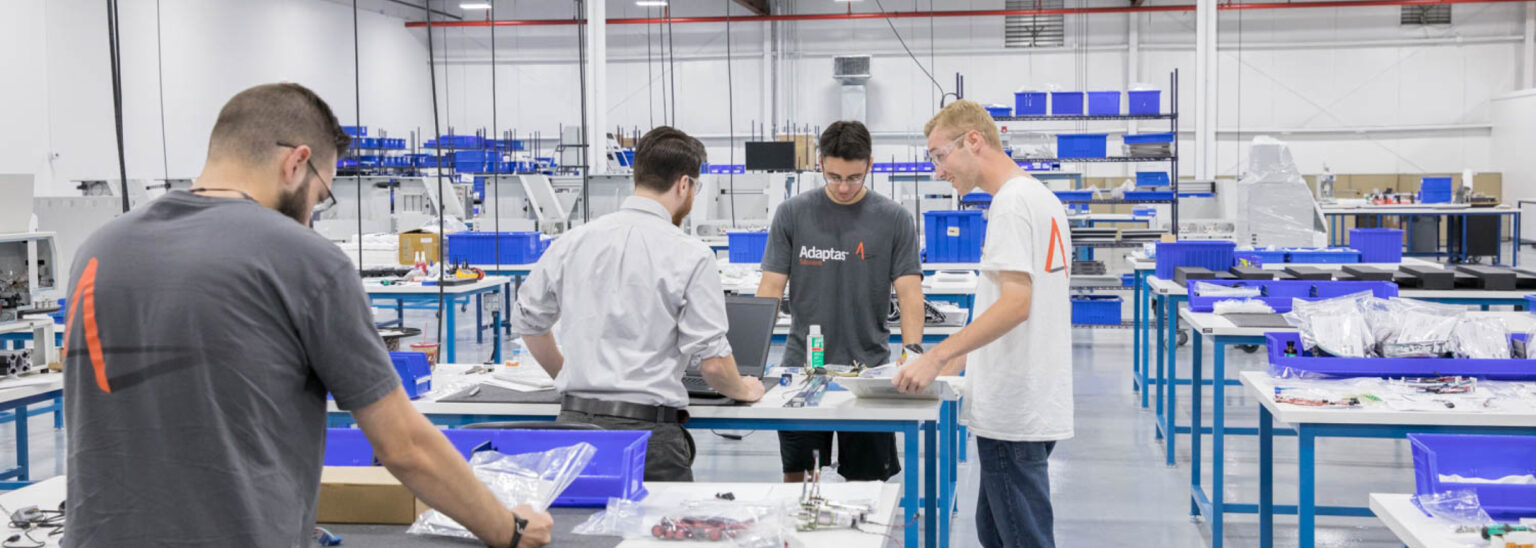

As the company grew and diversified, a rebranding became essential. The name “Adaptas” was chosen to reflect the core principles of adaptability, agility, and flexibility. These values were strongly influenced by Ampersand’s strategic approach, emphasizing the ability to view opportunities from a macro perspective, overcome challenges, and efficiently integrate diverse components.

The rebranding process was more than just a name change; it represented the unification of several acquisitions under a single umbrella. This unification required careful management to balance the needs of multiple stakeholders, including the original founders, the leadership of the acquired companies, and existing customers. With Ampersand’s support, Adaptas successfully navigated this challenge, creating a cohesive brand while maintaining the relationships of its constituent parts.

“The name Adaptas reflected what we were – highly adaptable, highly flexible, highly agile. These principles really resonated because of what Ampersand instilled in our business when they came in — the ability to look at opportunities, to look beyond the obstacles, and go fast.” –Jay Ray

Following those initial acquisitions and the rebranding, Ampersand helped the company maintain its growth trajectory by identifying a series of strategic acquisitions in 2020. Adaptas acquired Ceramax and Applied KiloVolts, two highly complementary instrument component divisions via a carve-out from L3Harris. Ceramax delivered capabilities in ceramic ion detectors while Applied KiloVolts enabled Adaptas to expand its product line to include power supplies and a European presence. The acquisition of Yuanshang Technology established a significant presence near Shanghai with contract manufacturing of IVD platforms and the acquisition of Cadence Fluidics that followed added HPLC valve offerings.

This significant diversification of the Adaptas product portfolio and increase in operational capacity and global reach positioned Adaptas as a dominant player in the mass spectrometry manufacturing market. This, combined with the strong customer relationships Adaptas had cultivated, began to attract significant interest from potential buyers, setting the stage for the company’s next chapter.

“Ampersand was very good at listening to the journey that I thought we should go on. They bought into that journey and deployed an entire team to research the market and go after the right acquisition targets.” –Jay Ray

Through a series of strategic moves, Adaptas and Ampersand had grown what was originally a niche, family-owned business into a global, diversified partner serving leading OEMs for mass spectrometry equipment. Following multiple purchase offers, Adaptas was sold to IMI plc in late 2021. The complex exit process was smoothly navigated, thanks to the expertise of Ampersand coupled with a strong collaboration with the Adaptas leadership team.

Adaptas’ successful journey not only created a legacy for the Roy and Ray family vison, but it also forged a lasting relationship between Jay Ray and Ampersand Capital Partners. After the sale of Adaptas, Jay transitioned into a new role as an Ampersand Operating Partner. In this capacity, he works closely with Ampersand’s portfolio companies, sharing the experiences and insights gained from his journey with Adaptas.

“I value being an Operating Partner and helping the next group of portfolio companies coming through. My journey with Ampersand is something that I think others can benefit tremendously from.” –Jay Ray

Disclosure: The case study and results included are for illustration purposes only and may not be typical. The case study should not be considered specific investment advice, do not take into consideration a specific situation, and are not intended to make an offer or solicitation for the sale or purchase of any securities or investment strategies. Investments involve risk and are not guaranteed. Case study testimonials were provided by clients between May 2024 – July 2024. The client was not compensated, nor are their material conflicts of interest that would affect the given testimony. The testimony may not be representative of the experience of other current clients and does not provide a guarantee of future performance success or similar services.

The statements provided herein are made by certain founders or executives of Ampersand’s past and/or current portfolio companies. Certain statements made herein are considered “testimonials” and express approval, support, or a recommendation of Ampersand, or describe the individual’s experience with Ampersand. The individual has not been directly compensated for making these statements. However, a portfolio company in which the individual held a significant equity interest may have received financial investment from Ampersand through one or more funds managed by Ampersand. As such, the individual may have an indirect financial interest in the success of Ampersand’s activities or in presenting Ampersand in a favorable light. Additionally, the individual may be an Operating Partner or Executive Advisor with Ampersand. As an Operating Partner or Executive Advisor, the individual performs certain services for Ampersand and may be compensated for providing these services. These potential conflicts of interest should be considered by prospective investors when evaluating the individual’s testimonial.

The individual’s statements reflect past, subjective experiences and are not indicative of future performance or success. Any testimonial made by the individual does not guarantee that future clients or portfolio companies will have similar experiences or achieve similar outcomes. Investment outcomes are subject to numerous risks and uncertainties, and there can be no assurance that any investment will achieve its objectives or that investors will not experience losses. This case study should not be considered specific investment advice, does not take into account any specific situation, and is not intended to make an offer or solicitation for the sale or purchase of any securities or investment strategies. Investments involve risk and are not guaranteed.